In projecting what you’ll need to save in order to generate enough retirement income, it helps to (1) prepare a realistic household budget and (2) understand what types of expenses you’ll have once you stop earning a regular paycheck.

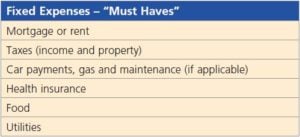

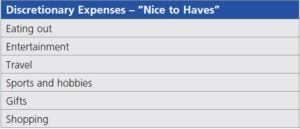

Types of expenses:

Sensible savers will plan to cover all must-have expenses before they consider splurging on nice-to-have items. You’ll also need to factor inflation into your expense projections: certain sectors of the economy, such as health care, have seen prices rise much higher than everything else.

How much should you take out of your savings?1

Retirement brings with it many unknowns, including how much you can spend each month from the so-called “three-legged stool” of Social Security, retirement plan and personal savings. Withdrawal amounts depend on how much you’ve saved and the expected return on your current investment mix and age, among other factors.

Much research has focused on what percentage of account value retirees can take each year so that the money won’t run out — assuming various rates of inflation. Some analysts suggest that 3.0% to 4.0% is a sustainable withdrawal-rate range in the early years of your retirement. A 4% withdrawal rate is considered sustainable except in cases where inflation creeps above 5%. But withdrawal rates of 5% or higher are risky, especially when inflation approaches 4%.2 Depending on the size and health of your nest egg and the growth rate of your expenses, you may be able to adjust this rate in future years.

Order of withdrawals can make a difference

Deciding which of the “three legs of the stool” to spend first depends to a great extent on tax laws. Most people know that delaying taking Social Security payments until age 70 can mean higher payments later; they may not realize that a portion of Social Security income is taxable at ordinary tax rates, which currently is set at a maximum 37%.

Remember that tax issues and IRS rules on qualified plan distributions can be very complicated. For example, although your money can grow tax-deferred inside a 401(k) or pension account, once you take a withdrawal, the entire distribution is hit with your ordinary-income tax rate and possible penalties if you’re under age 59½. On the other hand, selling stocks you hold in a taxable account means that only your capital gains will be taxed at the current maximum of 20% (depending on your income). Some think it’s best to take money first from regular taxable investment accounts and let tax-deferred accounts continue to grow.

Not everyone agrees with this strategy, though. Depending on your circumstances, some think it makes sense to withdraw money from your IRA and 401(k) before spending down your taxable assets. “The idea is to let the assets that will be taxed at the lowest rate accumulate for the longest time,” says Robert Carlson, author of The New Rules of Retirement: Strategies for a Secure Future. For example, if you think income tax rates will be higher in the future, you may want to spend down your taxable assets sooner. Consider enlisting the assistance of online tools or retaining a financial planner to tailor the order of withdrawals to your specific needs and tax situation.

Pensionmark Financial Group does not provide tax or legal advice. Please consult with a tax professional prior to deciding on any distribution option.

1Withdrawals from qualified plans prior to age 59½ may be subject to a 10% IRS penalty. Account values are subject to income tax upon distribution. This discussion is not intended to show the performance of any fund for any period of time or fluctuations in principal value or investment return. Periodic investment plans do not ensure a profit nor protect against loss in declining markets.

2Gerstein Fisher, “What’s a Sustainable Withdrawal Rate for a Retirement Portfolio?” Seekingalpha.com, May 1, 2018. https://seekingalpha.com/article/4168085-sustainable-withdrawal-rate-retirement-portfolio