There are many prescriptions to get to financial health. Here are four proven strategies to help you get there:

Setting and sticking to a budget

In 2017, 78% of Americans said they were living paycheck to paycheck, up from 75% three years earlier¹. Part of the reason may be that only 41% of us use a budget²,even though it’s one of the best ways to keep track of where our money goes.

Fortunately, it’s a pretty easy problem to fix. Try writing down what you spend every day for six months. At the end of six months, add up what you have spent in major categories (living expenses, transportation, dining out, and so forth), and see if what you’re spending money on brings you joy. If it doesn’t, time to create a budget! Budgeting is the process of taking control of your money, rather than trying to figure out where it went. Budgeting looks forward, not backward.

Saving for emergencies

Just 39% of U.S. households have the savings for an unexpected $1,000 outlay³, such as making out-of-the-blue house or car repairs. Many experts think you should have three to six months of living expenses stashed away. Saving up doesn’t need to be hard. Simply put $40 or $50 a month into an account, and let it build — it will help you feel more secure financially.

Paying down debt

The average household has $134,058 in debt, including credit cards, mortgages, and auto and school loans*. We suggest attacking two kinds of debt first:

- High-interest-rate credit cards: Every dollar you spend paying down a credit card that charges 19% per year is like getting a 19% return on that money.

- Small credit-card balances: Maybe you signed up for a store credit card and used it once or twice. Carrying a small balance may not seem like a big deal, but retiring this type of debt can give you an emotional boost.

Planning for retirement

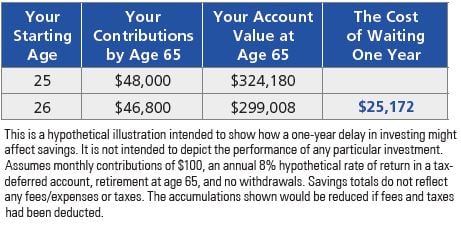

The median working age couple has only $5,000 saved for retirement, according to a Federal Reserve study**. Unfortunately, most people don’t start saving until it’s too late. There’s even a big cost if you delay savings just one year. Look at how much money a 26-year-old gives up by delaying the start of contributions by just 12 months:

¹Source: careerbuilder.com. National survey conducted online by Harris Poll on behalf of CareerBuilder from May 24 to June 16, 2018.

²Source: U.S. Bank, CNN.com, October 24, 2016. https://money.cnn.com/2016/10/24/pf/financial-mistake-budget/index.html

³Source: https://www.bankrate.com/banking/savings/financial-security-0118/

*Source: https://www.nerdwallet.com/blog/average-credit-card-debt-household/. Balances as of June 2018.

**Source: https://www.marketwatch.com/story/the-typical-american-couple-has-only-5000-saved-for-retirement-2016-04-28